What Is an ACH Payment?

There are essentially two sides to an ACH payment: an ACH debit and an ACH credit. As you can probably guess, ACH debits involve funds being pulled out of an account (like payment from a utility bill) and ACH credits involve funds being sent from an account (like an employer sending payment to their employee).

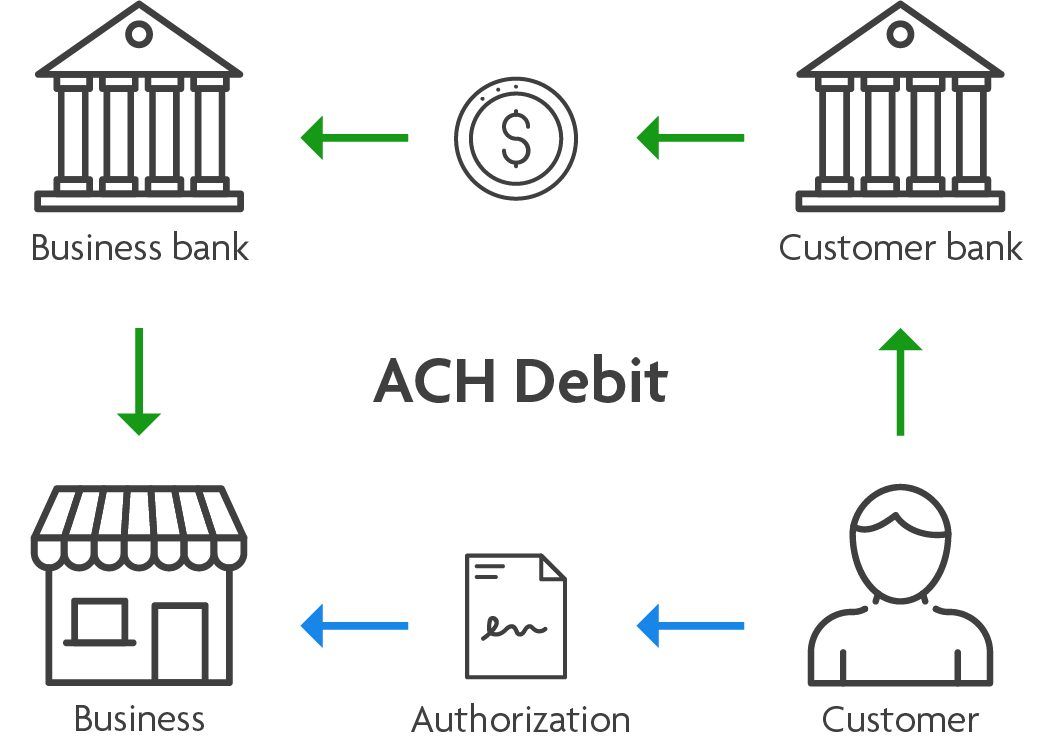

What is an ACH Debit?

An ACH debit is a bank-to-bank electronic transfer that is initiated by the payee (your business) when the payor (your customer) gives permission to do so. Permission is obtained through an ACH authorization form to outline the agreement and to make sure both sides are on the same page. ACH debits are a great fit for businesses that have an ongoing relationship with their customer and invoice them on a regular or recurring basis.

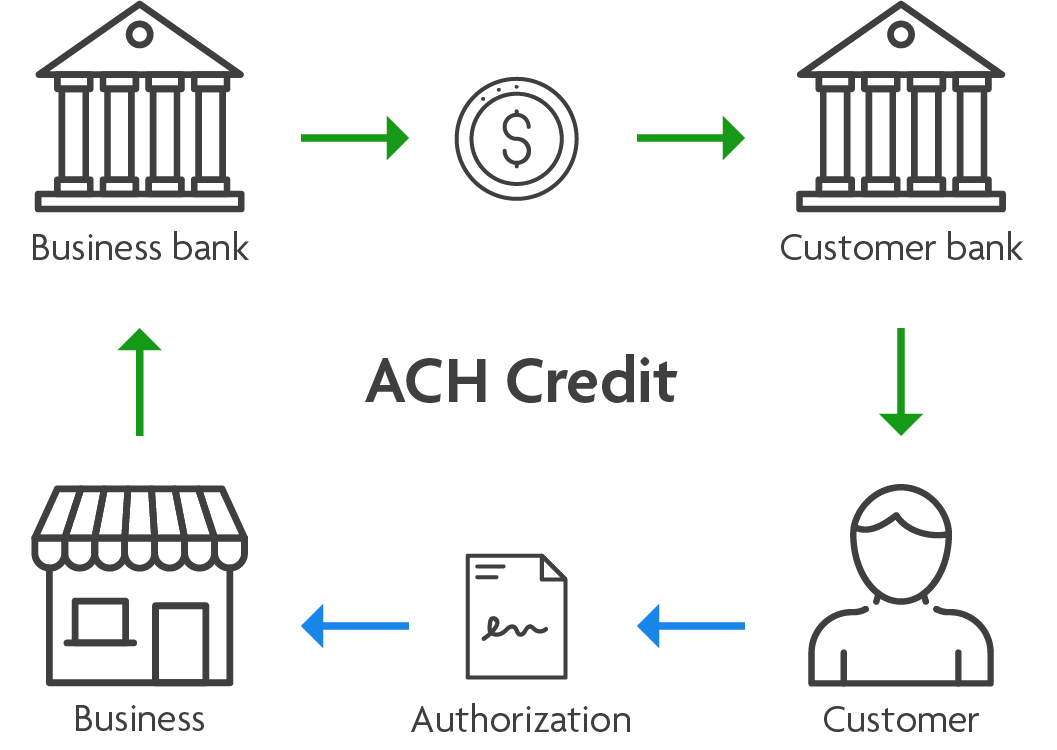

What is an ACH Credit?

An ACH credit is an electronic money transfer initiated by the payer to another bank account. The two most common types of ACH credits are direct deposit and direct payment.

Between the two, the most common form of ACH credit is direct deposit. Perhaps the best real-life example of a direct deposit is when a business uses it for payroll. As much as 94% of the American workforce gets their “paycheck” directly deposited into their bank account. This can be far more convenient than receiving a paper check that needs to be cashed or deposited and cleared before the funds can be accessed.

A direct payment is an ACH credit that is used as payment, as an alternative to checks or credit cards. From the business owner’s point of view, using ACH payments can eliminate the backend support needed for printing paper checks and mailing them. While that might not seem like a big deal for a small business, paper paychecks are costly, ranging from $4 to $20 per check. A business with just ten employees issuing bi-weekly paychecks could be spending over $1,000 a month on paychecks alone.

What Are the Advantages of Using ACH?

Get Paid Faster

ACH payments are initiated by the payee (your business). This is different than most processes that put an onus on the payor to initiate the payment. This means no more waiting for your customer to pay!